Travel and Expense

May 5, 2025

MICHAEL & SUSAN DELL FOUNDATION

Consultant and Contractor Travel and Expense Policy

The Michael & Susan Dell Foundation (the “Foundation”) is a non-profit charitable organization. Our mission is to transform the lives of children living in urban poverty through better health and education. All financial resources of the Foundation are dedicated to our mission and the children we serve, and it is in the spirit of this charitable mission that we expect all Foundation consultants and contractors (collectively, “Contractors”) to incur expenses in a cost-effective, prudent and frugal manner. This policy is issued for the Michael & Susan Dell Foundation and all Foundation-owned subsidiaries.

Travel Policy Statement

Contractors traveling for the Foundation must use economical and reasonable services when traveling on authorized Foundation business. The Foundation, in turn, will reimburse such Contractors for reasonable, necessary and lawful expenses incurred consistent with this policy while traveling on business for the Foundation. It is the responsibility of each Contractor and his or her Foundation project manager to monitor and control costs. Contractors are expected to exercise good judgment with respect to expenses and be alert to cost savings opportunities (e.g., better airfares with early reservations or alternate routings at lower prices). The Foundation will reimburse expenses only for Contractors serving the Foundation and not for anyone else traveling with a Contractor for personal or other non-Foundation authorized purposes.

Reimbursement Substantiation and Timing

All reimbursement requests must be submitted to the Contractor’s Foundation project manager no more than 60 days after incurring the expenses.

All expenses for Foundation travel must be properly documented. Proper documentation includes the business purpose, the designation and a detailed accounting of expenses, including original receipts for all expenses. Lodging charges must be supported by a receipt separately stating the costs for lodging, meals, telephone calls and other charges, regardless of the amount.

A travel expense report should be submitted to the Foundation within 60 days of the end of the trip. A travel expense report must be completed for each trip taken; trips on different dates may not be combined into one report.

If a Contractor is taking a spouse/significant other on a trip, all costs associated with that person’s travel are considered personal expenses and will not be reimbursed by the Foundation.

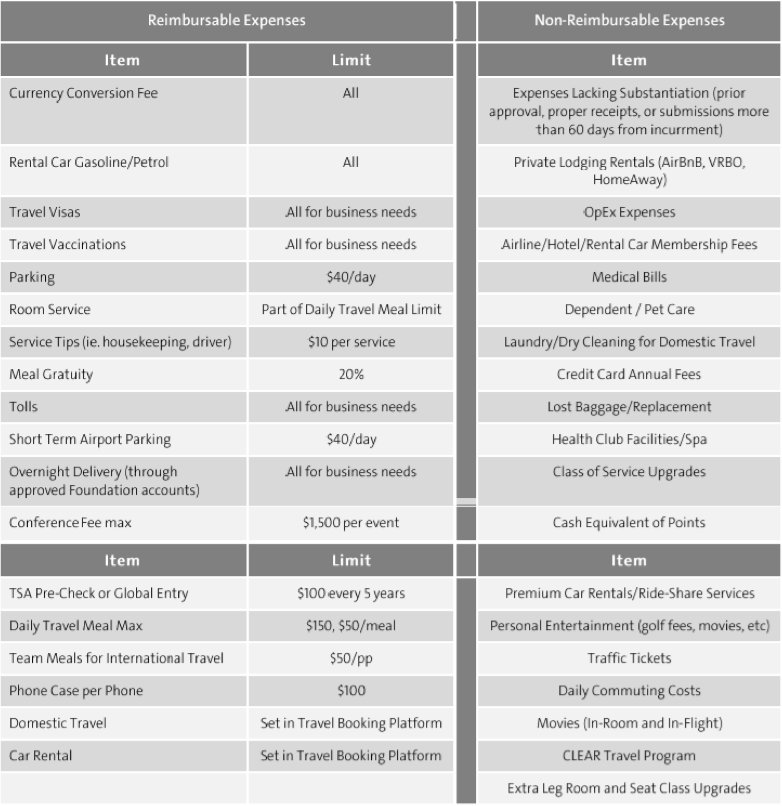

Please see the table on Page 4 of this policy for representative details of what expenses are and are not reimbursable.

Pre-trip Travel Authorization

Contractors must obtain, in writing (email will suffice), approval for a trip from their Foundation project manager prior to traveling. The request for travel authorization must include a clear explanation of the purpose of the trip. Contractors may use travel agencies or websites to arrange their travel and must charge travel costs to their own personal or institutional credit card.

Airline Class & Tickets

If travelling by air, lowest economy (coach) airfare must be used for domestic and international travel, and reservations should be made as far in advance as possible to secure possible discounts. Airline tickets must be booked a minimum of seven days prior to the date of travel. If unforeseen business circumstances arise and the Contractor is unable to purchase the tickets seven days in advance, pre-approval by the Contractor’s Foundation project manager must be obtained.

Contractors will be reimbursed for main cabin airfare costs only. If a Contractor wishes to fly at a higher class, he or she must provide the Foundation with the information for the cost of the coach fare for the trip to receive reimbursement at the coach rate. The coach fare will be reviewed for reasonableness prior to reimbursement. Under most circumstances, non-refundable tickets should be purchased, if available, as the savings are typically substantial.

Seat upgrades such as Business/First class and extra leg room fees are not reimbursable for flights with reserved seating unless a specific medical condition requires such accommodation. Flights which do not provide reserved seating are eligible for pre-boarding cost reimbursement on coach fares (e.g. early bird check-in on Southwest Airlines or seat reservation fees.)

Lodging

Contractors should stay at moderately priced hotels. The lowest room rate offered for a single standard room should be selected. Absent special circumstances, the cost of upgrading to a superior room will be considered a personal expense. Contractors may stay in hotels that are designated as the official hotel for a conference if a room is available. If there are no longer any rooms available at the conference rate, and the hotel’s general rates are considered excessive, other alternatives should be explored. If travel plans change, it is the Contractor’s responsibility to cancel any guaranteed hotel reservations in a timely fashion to avoid an expense to the Foundation. This will vary from hotel to hotel and it is the Contractor’s responsibility to know the hotel’s cancellation policies. Cancellation fees resulting from failure to cancel reservations within the hotel’s policies will need to be specifically documented as to why the reservations were not canceled on time. Reasoning outside of Foundation-related business may deem the cancellation fee non-reimbursable.

As per IRS regulations, the Contractor is responsible for obtaining and attaching to the travel expense report a receipt for the hotel expenses that includes:

-

- The name and location of the hotel;

-

- The dates stayed; and

-

- Separate amounts for charges such as lodging, meals and telephone calls.

The Contractor must subtract all personal expenses as noted in the table below and will not be reimbursed for disallowed or unauthorized expenses. Domestic lodging must not exceed the following nightly rates per geography, excluding fees and taxes. Any exceptions should be documented with specific reasoning and approved by the project manager prior to travel.

Ground Transportation

Contractors should use the most economical mode of transportation as dictated by scheduling and business needs and are expected to share transportation when possible.

Except to the extent necessary to accommodate several travelers, a mid-size or intermediate size car is considered reasonable.

If personal or corporate auto insurance is not available, Contractors should purchase the insurance provided by the car rental agency to ensure protection. Contractors should also refuel before returning the car or prepay for gasoline to save on high gasoline fees charged by rental companies.

Personal vehicles can be used if it’s more economical to do so. Mileage/tolls/parking in such cases will be reimbursed. The Foundation will reimburse personal vehicle usage based on the IRS standard mileage rates. Gas will not be additionally be reimbursed as it is factored into the IRS mileage rate. Ground travel outside of the US may apply the local country equivalent of this government approved rate.

The Foundation prohibits its Contractors from using cell phones while driving on Foundation business. Please wait until you have reached your destination or made a stop to make cell calls, text, or reply to emails.

Ride shares (e.g. Uber and Lyft) should only be used if it is the most economical option for your business needs. Surge pricing should be considered when selecting a ride share over a cab. Ride shares should always be booked and paid for through the application. Any charges or tips incurred outside of the application are not reimbursable expenses. Premium cars such as, but not limited to, Uber Black or Uber Lux are not permitted for reimbursement.

Meals and Entertainment

Any exceptions to the meal per diems must obtain written approval prior to travel expenses being incurred.

The Foundation will not reimburse for gifts, tickets or any other entertainment for any purpose whatsoever.

Telephone Calls & Internet

The Foundation will reimburse Contractors for telephone calls and internet access charges made related to Foundation business. Contractors needing to conduct business on behalf of other clients should not request reimbursement for those charges from the Foundation. If possible, Contractors should use company provided hotspots for internet security.

Travel Expenses

Taxpayer Identification Number

For the Foundation to comply with IRS reporting requirements (e.g., issuance of 1099s, etc.), individuals or entities requesting reimbursement will be required to provide appropriate tax payer identification. Failure to provide all necessary information may result in denial of reimbursement.

Acknowledgement

Contractors must acknowledge that they have read and agree to abide by this policy before the Foundation will provide any reimbursements. The Foundation will hold the signed acknowledgement on file and consider it valid for the entire term of the Contractor’s engagement. The Foundation reserves the right to update this policy at any time, and Contractor agrees to be bound by the updated policy upon written notice.

Effective Date

This policy is effective May 5, 2025.